CRM is Now the Centre of the Intelligent Enterprise

Abstract

Modern CRM platforms have evolved from contact databases into foundational business infrastructure. This paper examines CRM’s role in unifying customer data, automating cross-functional workflows, enabling AI-driven decision-making, and supporting regulatory compliance, positioning CRM as a core system underpinning scalable, customer-centric, data-driven organisations.

Introduction

CRM as the Technological Foundation for Business Infrastructure: Beyond Contact Management

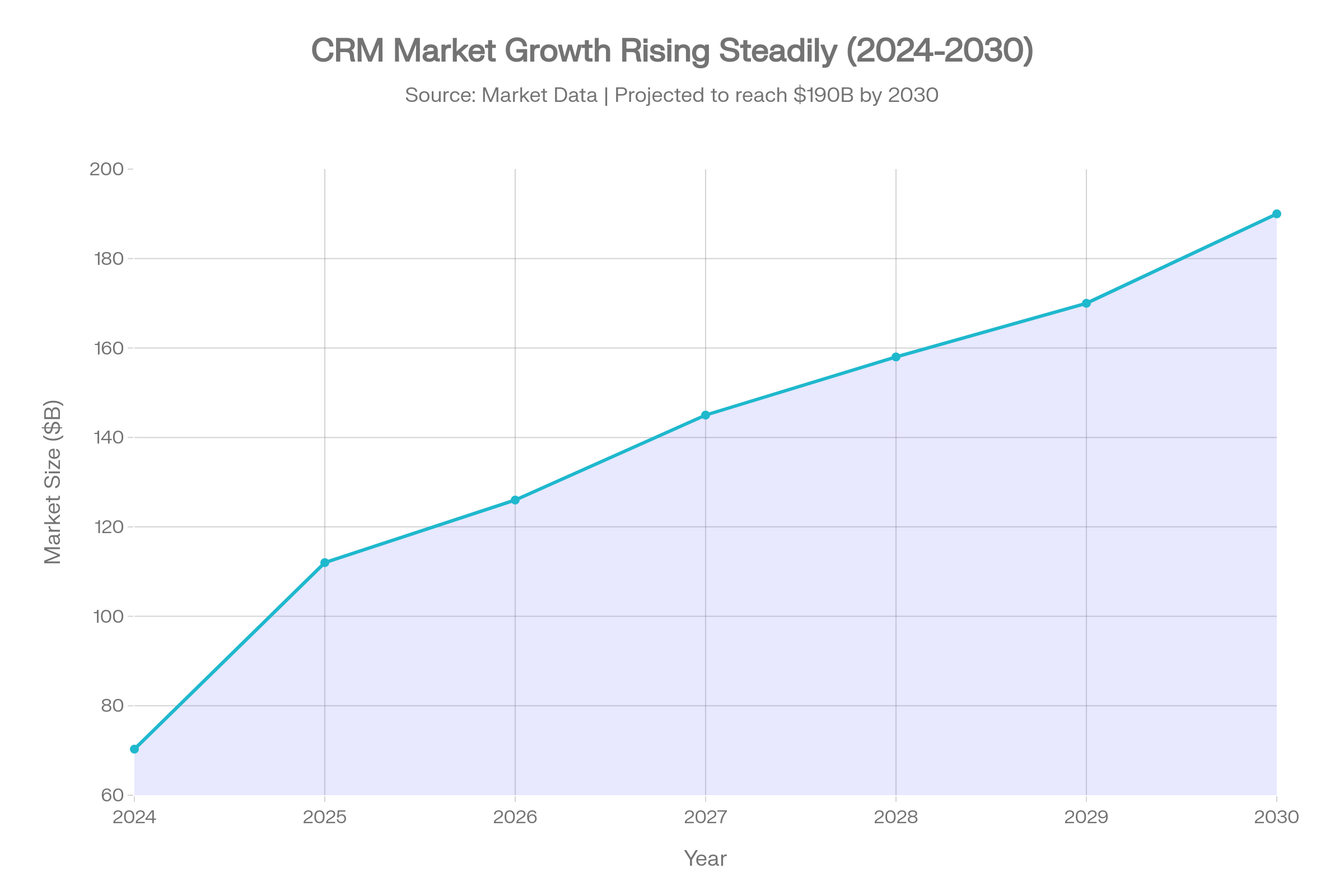

Customer Relationship Management (CRM) has evolved beyond a repository for contact information. In 2024-2025, modern CRM systems function as the operational backbone of both small and large enterprises, integrating customer data, automating critical workflows, and enabling data-driven decision-making at scale. With the global CRM market valued at over $112 billion and projected to reach $190 billion by 2030, this transformation reflects a fundamental shift in how organisations conceptualise their technology infrastructure. Over 91% of companies with ten or more employees now deploy CRM systems, with adoption accelerating among small and medium-sized enterprises at 9.54% annually, outpacing growth in the enterprise segment. The evidence is clear: CRM is no longer discretionary. It is foundational infrastructure that determines competitive viability, operational efficiency, and the capacity to deliver personalised customer experiences at scale.

The Evolution: From Contact Database to Business Foundation

The Evolution: From Contact Database to Business Foundation

The trajectory of CRM reflects broader digital transformation imperatives. Two decades ago, CRM systems primarily solved a logistical problem: centralising scattered contact information into searchable databases. Sales teams transitioned from Rolodexes to platforms like Salesforce or Microsoft Dynamics, gaining visibility over prospect pipelines and interaction history.

This functionality, while valuable, proved incomplete. As business complexity increased, with sales, marketing, customer success, and finance teams operating in parallel, isolated CRM systems created information silos. A sales representative might update a deal stage in the CRM without visibility to pending service issues, billing disputes, or customer support interactions. Data fragmentation bred operational inefficiency and prevented coherent customer engagement strategies.

Cloud computing fundamentally altered this dynamic. SaaS-based CRM platforms eliminated infrastructure barriers that once constrained adoption to large enterprises. By 2025, 87% of deployed CRM systems operate on cloud infrastructure, with no-code workflow builders and freemium entry tiers accelerating adoption among organisations that previously viewed enterprise CRM as financially prohibitive. Equally important, modern CRM architectures now integrate with enterprise resource planning systems, data warehouses, and marketing automation platforms, positioning CRM as the connective tissue between previously disconnected operational domains.

Today's CRM systems function as unified systems of engagement, the operational layer where customer interactions occur, synchronised with systems of record that maintain authoritative customer data. This architectural shift has transformed CRM from a tactical contact management tool into a strategic foundational infrastructure.

Figure 1: Global CRM Market Growth Trajectory, 2024–2030

Three Core Business Capabilities Enabled by Modern CRM Platforms

Unified Customer Intelligence and Actionable Insight

Unified Customer Intelligence and Actionable Insight

Modern CRM systems aggregate customer data across touchpoints: sales interactions, support tickets, marketing engagement, purchase history, and behavioural signals. This consolidation creates what executives call a "360-degree customer view": a single, authoritative record that eliminates spreadsheet duplication and departmental data conflicts.

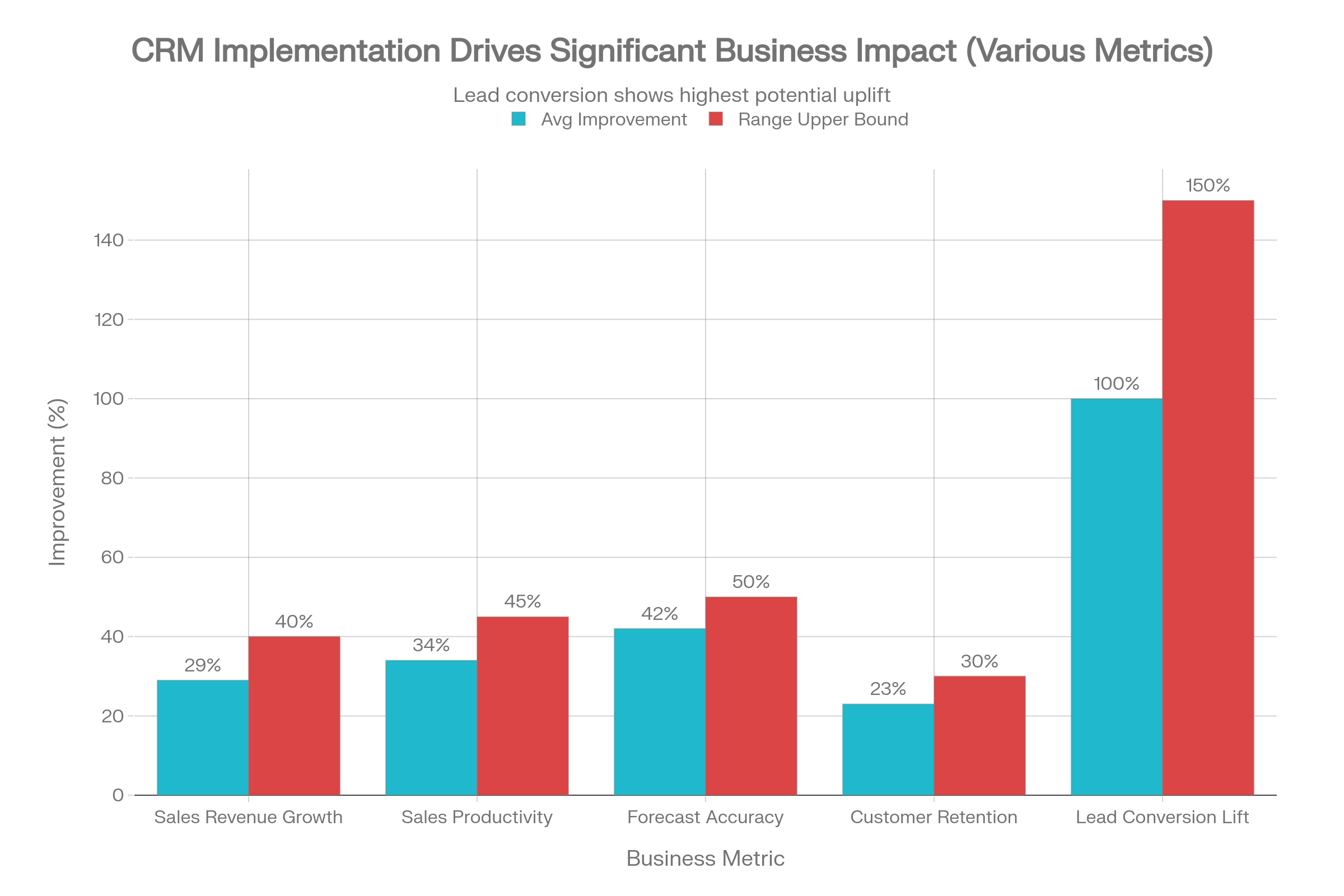

The business consequence is measurable. Sales forecasting accuracy improves by 32-42% when reps access complete customer context within the CRM. Marketing teams deploy personalised campaigns informed by purchase history and engagement patterns, achieving 14% higher click-through rates than generic approaches. Customer success teams identify churn risk signals early, enabling proactive retention interventions. The value accumulates because functional teams operate from consistent information, reducing miscommunication and enabling faster decision-making.

For organisations managing data across multiple legacy systems, common in mid-market and enterprise environments, this unification function becomes existential. Without a consolidated data foundation, analytics and AI initiatives fail before launching. Progressive organisations are therefore deploying customer data platforms (CDPs) or data warehouses alongside their CRM, creating scalable architectures that scale with organisational ambition.

Automated Workflows and Operational Efficiency

Automated Workflows and Operational Efficiency

CRM platforms automate routine tasks that historically consumed enormous sales and customer service bandwidth. Lead scoring algorithms identify high-potential prospects automatically. Workflow rules trigger follow-up actions, email sequences, task assignment, and escalation protocols without manual intervention. Support ticketing systems route cases based on expertise and load, reducing first-contact resolution time.

The efficiency impact ranges from 20-35% improvement in operational productivity, with average ROI reaching $8.71 for every dollar invested in CRM. For field sales teams, mobile CRM access multiplies this effect: reps update pipeline status, log activities, and capture insights in real-time rather than during end-of-day data entry sessions. Organisations deploying mobile CRM experience 150% improvement in the likelihood of exceeding sales quotas versus those relying on desktop-only access.

Critically, automation benefits extend beyond sales. Support teams handle increased case volumes without proportional staffing expansion. Marketing automation embedded in CRM enables nurture sequences that keep prospects engaged across extended sales cycles. Finance teams integrate CRM data with accounting systems, automating invoice generation and payment tracking. This multiplier effect, one platform automating workflows across multiple functions, explains why 82% of companies deploy CRM specifically for process automation and reporting.

Predictive Analytics and Strategic Decision-Making

Predictive Analytics and Strategic Decision-Making

AI integration within CRM has accelerated dramatically. Predictive models now forecast deal probability, customer lifetime value, and churn risk with increasing accuracy. Machine learning algorithms identify optimal times for outreach, recommend relevant products, and detect anomalies signalling potential customer dissatisfaction.

The implications extend to C-suite decision-making. Instead of monthly reports compiled from multiple systems, executives access real-time dashboards showing pipeline health, win/loss analysis, and customer health metrics. This immediacy accelerates response to market changes. A manufacturing company that detects early churn signals in a major account segment can mobilise customer success resources before revenue impact compounds. Marketing leaders adjust campaign spending based on real-time conversion data rather than waiting for post-campaign analysis.

The market is responding to this capability. AI in CRM systems represents a $11.04 billion market segment in 2025, with 65% of organisations adopting CRM platforms with generative AI capabilities. This investment signals confidence that AI-augmented CRM systems generate tangible business value beyond conventional reporting.

Real-World Case Studies: Organisations Using CRM as Foundation

Copyright Agency (Australia), Enterprise Transformation

Copyright Agency (Australia), Enterprise Transformation

The Copyright Agency, a membership organisation managing intellectual property licensing across Australia, undertook a comprehensive digital transformation anchored on Salesforce CRM. The organisation had been operating with 17 separate revenue streams, each supported by legacy systems that created operational complexity and manual data reconciliation requirements.

The transformation wasn't simply a platform replacement. Copyright Agency invested in business process redesign first, involving frontline teams in system design and testing. Data consolidation across legacy systems was completed prior to CRM go-live, ensuring data quality. Once streamlined processes were mapped within Salesforce, automation was systematised in phases, financial systems first, then core business functions.

The outcome: Member portal modernisation, reduced operational complexity, increased transparency, and a platform designed for future enhancements without system redesign. Copyright Agency had transformed CRM from a sales tool into an organisational infrastructure capable of supporting evolving member needs and business model innovation.

TechFlow Manufacturing, Mid-Market AI Integration

TechFlow Manufacturing, Mid-Market AI Integration

TechFlow, a mid-sized manufacturing company, confronted a persistent sales challenge: missed quarterly targets despite a competent sales team, hampered by time-intensive manual research and a lack of coaching insights. Rather than wholesale CRM replacement, leadership deployed a focused $500/month AI strategy: an AI prospecting platform feeding pre-qualified leads to the existing CRM, coupled with conversation intelligence analysing every sales call, and automated follow-up sequences.

Critically, the implementation succeeded through methodical execution:

- Dedicated infrastructure preparation ensuring clean data

- Staggered tool rollout, allowing team mastery before adding complexity

- Customisation addressing manufacturing-specific sales challenges

Within 90 days, pipeline acceleration was evident. The case demonstrates that CRM's foundational power derives not from complexity but from disciplined integration with organisational workflows.

Retail Enterprise, Customer Retention Foundation

Retail Enterprise, Customer Retention Foundation

A retail organisation used CRM data to identify at-risk customers and deploy targeted retention campaigns. The platform enabled 45% improvement in customer retention and 30% increase in customer lifetime value. Combined with 10% cost reduction through automation, the organisation achieved 350% ROI, a return that justified not only the CRM investment but the entire customer-centric operating model it enabled.

Data Security and Regulatory Compliance: CRM as Trust Infrastructure

Data Security and Regulatory Compliance: CRM as Trust Infrastructure

The proliferation of data protection regulations, GDPR in the EU, CCPA in California, and Australia's Privacy Act updates has reframed CRM implementation as a compliance imperative. Data breaches targeting SaaS platforms, including CRM, account for 43% of security incidents, yet organisations deploying secure CRM infrastructure experience a measurable advantage.

Modern CRM platforms address compliance through architectural design:

- Role-based access control ensures employees have access only to customer data relevant to their function

- Data encryption at rest and in transit prevents unauthorised access

- Audit trails document every customer record interaction, creating accountability and audit-ready compliance evidence

- Consent management features embedded in CRM platforms enable automated tracking of customer preferences, essential for GDPR and CCPA compliance

The market reflects this reality: 60% of large organisations expect to deploy privacy-enhancing technologies within CRM infrastructure by year-end 2025. Organisations investing in secure CRM architecture simultaneously mitigate regulatory risk and build customer trust, increasingly a competitive differentiator.

Implementation Considerations: Right-Sizing CRM for Organisational Maturity

Implementation Considerations: Right-Sizing CRM for Organisational Maturity

Successful CRM deployment requires matching platform ambition to organisational readiness and complexity.

- Enterprise: Implementations demand sustained executive sponsorship, dedicated change management resources, and multi-month timelines. Salesforce remains the dominant enterprise choice because of its flexibility and ability to accommodate complex, global customer ecosystems. However, this power comes with governance requirements and learning curves that necessitate senior leadership commitment.

- Mid-market: Organisations increasingly choose HubSpot for its 6–8 week implementation timeline and exceptional user adoption rates. The platform balances functionality with usability, enabling cross-functional teams to generate results quickly without extensive customisation.

- Small businesses and startups: Leverage freemium CRM tiers, such as HubSpot, which attracted over 200,000 new SME users through its free tier in 2024, or low-cost alternatives like Zoho that prioritise ease of use and rapid deployment.

Across all segments, a critical success factor emerges: data readiness precedes platform selection. Organisations that invest in data cleaning, consolidation, and governance before CRM implementation experience significantly faster time-to-value and higher user adoption. This foundational discipline determines whether CRM becomes a transformative infrastructure or another system gathering dust.

Forward-Outlook: Strategic Imperatives for 2025 and Beyond

Forward-Outlook: Strategic Imperatives for 2025 and Beyond

CRM technology is approaching inflection points. AI integration is transitioning from novelty to table-stakes capability. Integration with ERP and data warehouse infrastructure is becoming an essential architecture rather than an advanced option. Cloud deployment now represents 87% of CRM installations, with on-premises systems becoming a niche.

For organisational leaders, the strategic question is not "should we adopt CRM?" (91% of mid-sized companies already have, and adoption among SMEs continues accelerating). The question is: Is our CRM functioning as a foundational infrastructure, unified, secured, intelligently automated, or as an isolated system creating bottlenecks rather than eliminating them?

Organisations that answer affirmatively, that have unified customer data, eliminated silos, embedded automation, and integrated CRM with adjacent systems, are measurably outperforming peers.

- Sales productivity increases 34%

- Revenue grows 29%

- Forecast accuracy improves 42% on average

- Customer retention improves 23% among SMEs deploying integrated CRM

These aren't marginal improvements; they're transformative shifts that compound over time.

CRM has become the strategic technology that enables data-driven cultures, customer-centric operating models, and the scaled personalisation that modern buyers expect. The competitive imperative is clear: invest in modern CRM infrastructure, ensure data quality, and orchestrate integration across your operational ecosystem. The organisations that do will compound structural advantages over those that view CRM as tactical contact management. In 2025, the distinction separates market leaders from followers.

References

Statista. (2025). Customer Relationship Management (CRM) software market size worldwide. [Statista](https://www.statista.com/outlook/tmo/software/enterprise-software/customer-relationship-management-software/worldwide) Mordor Intelligence. (2026). Customer relationship management market size, share & trends report. [Mordor Intelligence](https://www.mordorintelligence.com/industry-reports/customer-relationship-management-market) Technavio. (2025). Customer relationship management (CRM) market analysis, size, and forecast 2025–2029. [Technavio](https://www.technavio.com/report/crm-market-industry-analysis) Information Technology & Innovation Foundation. (2025). How digital services empower SMEs and start-ups. [itif](https://itif.org/publications/2025/08/27/how-digital-services-empower-smes-and-start-ups/) Fluss, D. (2024). The best small and midmarket CRM suite: The 2024 CRM industry report. Destination CRM. [CRM Industry](https://www.destinationcrm.com/Articles/Editorial/Magazine-Features/The-Best%C2%A0Small-and-Midmarket-CRM-Suite-The-2024-CRM-Ind) NRI ANZ. (2023). Salesforce CRM provides the foundations to true business transformation. [NRI ANZ](https://nri-anz.com/case-study/salesforce-crm-provides-the-foundations-to-true-business-transformation/) M Accelerator. (2025). The $500/month AI strategy that’s transforming mid-market sales teams. [M Accelerator](https://maccelerator.la/en/blog/enterprise/the-500-month-ai-strategy-thats-transforming-mid-market-sales-teams/) SuperAGI. (2025). Real-world results: Case studies of companies that saw significant ROI with agentic CRM implementations. [SuperAGI](https://superagi.com/real-world-results-case-studies-of-companies-that-saw-significant-roi-with-agentic-crm-implementations/) SuperAGI. (2025). Securing the future of CRM: Navigating data privacy, advanced security, and personalised customer experiences. [SuperAGI](https://superagi.com/securing-the-future-of-crm-navigating-data-privacy-advanced-security-and-personalized-customer-experiences)